At the end of 2019, PJSC Evropeyskaya Elektrotekhnica increased its profits by 2.0 %; revenue was down by 0.5 % (IFRS)

At the end of 2019, PJSC Evropeyskaya Elektrotekhnica increased its profits by 2.0 %; revenue was down by 0.5 % (IFRS)

May 13, 2020. Moscow — PJSC Evropeyskaya Elektrotekhnica, a leading company in the Russian engineering market, publishes its consolidated financial results as per IFRS for 2019.

Financial statements are available on the corporate website, section For Investors, subsection Financial Statements: http://euroetpao.ru/investors/.

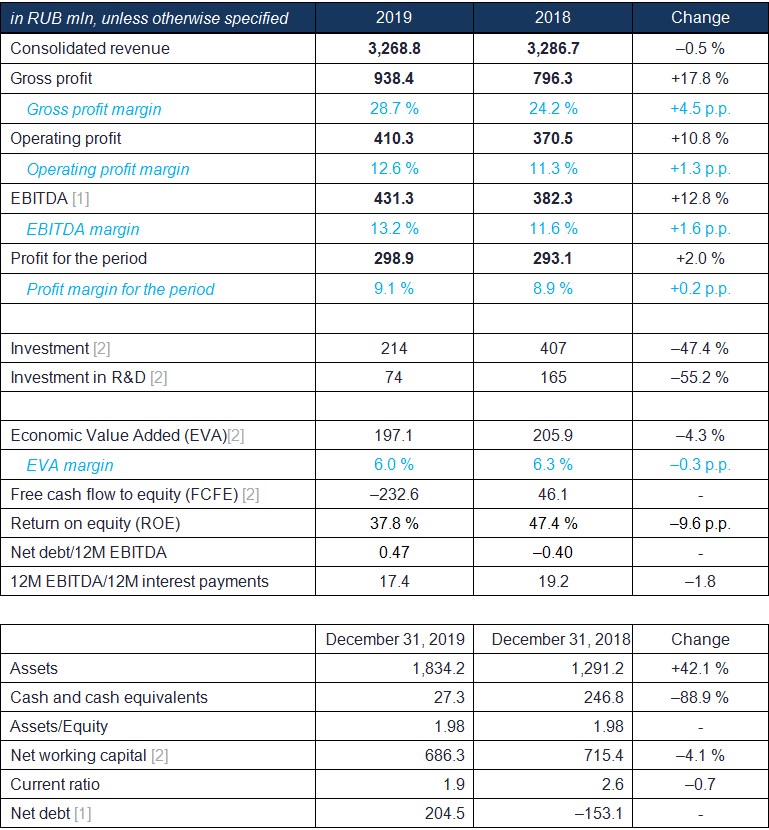

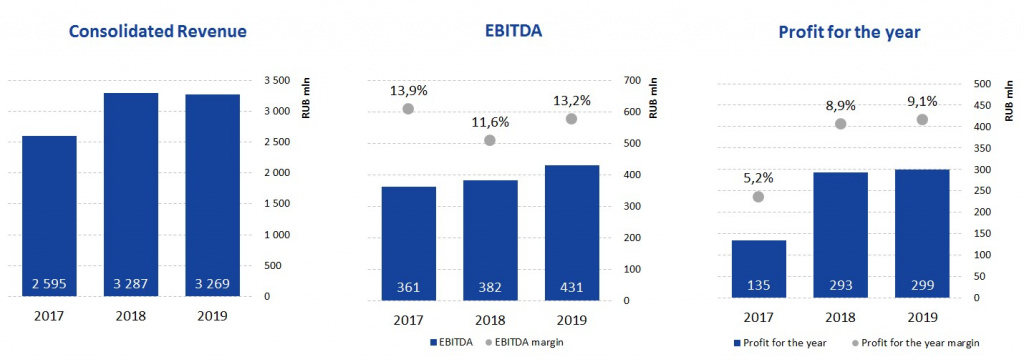

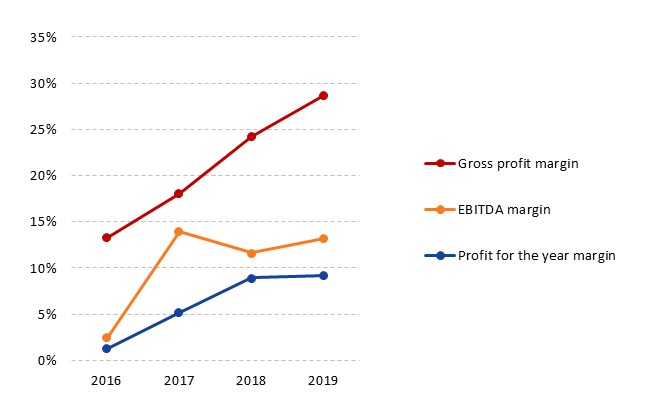

The volume of consolidated revenues slightly decreased in the reporting period, to RUB 3,268.8 million — 0.5 % lower than in 2018, and profit grew by 2.0 % to RUB 298.9 million. EBITDA amounted to RUB 431.3 million (+12.8 % Y-o-Y), and its margin was up to 13.2 % (+1.6 p.p.).

Key financial indicators:

Source: PJSC Evropeyskaya Elektrotekhnica's Consolidated Financial Statement for 2019 as reviewed by audit company FBK Grant Thornton.

Notes:

[1] Non-IFRS indicators; the calculation procedure is given below in this press release.

[2] Non-IFRS indicators.

Statement from Management

Sergey Dubenok, Head of PJSC Evropeyskaya Elektrotekhnica Board of Directors, commented on the financial performance:

"At the end of 2019, the Company has once again raised the profitability of its activities. In this period, its profit margin amounted to 9.1 %, which is 0.2 p.p. higher compared to 2018. Our strategic decision to focus on high-margin business lines and increase the Company's profits continues to have a positive effect on the financial performance.

In the second year, our economic value added (EVA) remains at the levels of around RUB 200 million. In contrast to the accounting profit, this indicator reflects the financial standing more adequately. EVA demonstrates the Company's real ability to generate profits on total capital invested in the business.

In the year under review, both areas of our activity showed a steady growth, while revenues and profits became more diversified as the Process Systems direction intensified. Starting from 2020, the Company's reports will incorporate more significant financial results of this direction.

We continue to produce and install innovative units of various types at customers' facilities on the principles of separation of the economic effect of their operation. For example, we have to complete the commissioning of our equipment at three CHPPs in Ecuador, which will provide for considerable saving of fuel oil (energy). The launch of this equipment was delayed due to the suspension of international air traffic against the backdrop of coronavirus infection spread. For the same reason, testing of a similar unit in the city of Murmansk has been shifted to September 2020.

Last year, one of the largest companies in the Russian Oil&Gas market decided to buy a mobile preliminary water knock-out unit which had previously been leased by us. We put the unit into operation in August 2019, and the equipment fully confirmed the declared operational parameters.

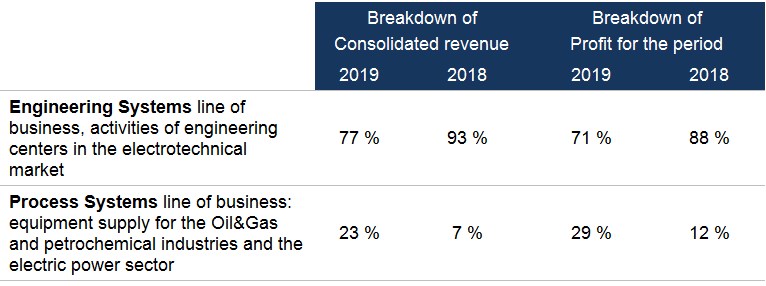

The share of the Process Systems direction in the Company's revenue structure rose to 23 %, with profitability exceeding the Engineering Systems direction indicators. These dynamics correspond to our original plans.

The coronavirus crisis that took place after the reporting period should be noted as a material factor for our business. Despite its global nature, large and medium-sized investment projects in which we participate are still on track. However, we believe it is possible that the period of payment for ongoing projects will be extended, as well as projects’ implementation phase will be prolonged. This places higher demands on our risk management system and requires regular monitoring of our customers' and partners' progress."

Factors of change in the Company's key financial indicators

Consolidated revenue

The Company's consolidated revenues totaled RUB 3,268.8 million, down 0.5 % year-over-year.

Contribution of core activities in the Company's financial indicators, 2019

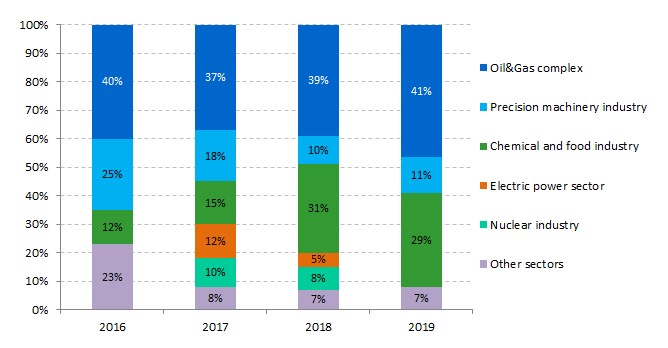

In recent years, Oil&Gas customers account for the major share of the Group's contracts (in terms of delivery costs). The second sector with a significant share in the Company's supply volume is the chemical and food industry:

Key factors of consolidated revenue change:

- The deferred income from the new business for leasing innovative units for oil refining and the electric power sector had a deterrent effect on revenue in the reporting period. The Company publicly announced the launch of a new area of activity in May 2019, even though significant revenue had not yet been received in the course of the reporting period. The corresponding investment and expenses, however, had already been carried out.

- In the reporting period, the revenue structure contained 9 % of revenues from deliveries of engineering and technological products for export to customers from Uzbekistan, Ecuador, and Azerbaijan.

- Level of income concentration in 2019: in the structure of the Company's consolidated revenue, the share of contracts concluded with Top 10 customers was 65.7 %.

- In the reporting quarter, the Company opened another engineering center in the city of Quito, the capital of the Republic of Ecuador (South America). The new center will specialize in the provision of services in the Process Systems line of business, and it will also participate in the development of the country's oil industry and the introduction of environmentally friendly technologies. Cooperation with customers from Ecuador and neighboring countries has major potential for our business. We are also planning to enter the Colombian market in the near future.

Dynamics of the Company's key financial indicators

Cost of Sales and Gross Profit

The cost of sales in the reporting period amounted to RUB 2,330.4 million. Introduction of scientific developments allows the Company to produce more sophisticated equipment (for example, metal consumption for structures is significantly reduced), which provided a 6.4 % decrease in its cost. Gross profit increased to RUB 938.4 million (+17.8 % compared to 2018). The Company's gross profit margin grew to 28.7 % (+4.5 p.p.).

Administrative and Selling Expenses

|

in RUB mln |

2019 |

2018 |

Change |

|

Wages and social contributions |

243,747 |

164,898 |

47.8 % |

|

Electrical installation works |

63,792 |

16,101 |

296.2 % |

|

Transport services |

48,225 |

52,956 |

–8.9 % |

|

Other expenses |

33,149 |

22,791 |

45.4 % |

|

Short-term (operating) lease |

23,052 |

16,449 |

40.1 % |

|

Business trips |

21,370 |

20,112 |

6.3 % |

|

Consulting and legal services |

16,663 |

29,102 |

–42.7 % |

|

Depreciation charges |

18,186 |

9,527 |

90.9 % |

|

Information services |

9,201 |

41,451 |

–77.8 % |

|

Materials and office supplies |

8,236 |

36,202 |

–77.2 % |

|

Bank services |

5,448 |

2,277 |

139.3 % |

|

Communication |

4,228 |

3,736 |

13.2 % |

|

Marketing services |

3,070 |

483 |

535.6 % |

|

Repair and maintenance |

4,297 |

3,761 |

14.3 % |

|

Insurance |

1,358 |

1,615 |

–15.9 % |

|

Storage |

294 |

100 |

194.0 % |

|

Security |

312 |

296 |

5.4 % |

|

Taxes |

6 |

272 |

–97.8 % |

|

TOTAL |

504,634 |

422,129 |

19.5 % |

Higher expenses for wages and social contributions (a growth of 47.8 %) in the reporting year is due to an increase in the number of Evropeyskaya Elektrotekhnica Group of Companies personnel by 200 % after the consolidation of controlled company ROG-Engineering LLC. 2019 became the first full year when wages were paid to employees of a new company along with associated taxes and fees.

ROG-Engineering produces equipment for the Oil&Gas and petrochemical industries. A team of professionals has been established at the production site in Bashkortostan.

The reduction in transport expenses (–35.2 %) is due to the fact that delivery expenses can be paid either by a Group company or customer, depending on the contractual terms. In addition, the geographical location of customers' facilities varied drastically in different reporting periods. These factors mean that the total amount of transport expenses may vary considerably in different periods.

Operating profit

The Company's operating profit grew by 10.8 % to RUB 410.3 million. Operating profit margin increased to 12.6 % (+1.3 p.p.).

EBITDA

EBITDA reached RUB 431.3 million (+12.8 % Y-o-Y). EBITDA margin increased to 13.2 % in the reporting period (11.6 % in 2018).

Profit Before Tax

Profit before tax increased by 6.3 % to RUB 381.5 million. Profit before tax margin increased to 11.7 % (+0.7 p.p.).

Profit for the period

At the end of the reporting period, the Company's profit was up to RUB 298.9 million, a 2.0 % increase against 2018. The profit margin increased to 9.1 % from 8.9 % in the previous year.

ROE

The Company's return on equity (ROE) decreased to 37.8 % (47.4 % in the previous year). Lower ROE was caused by reduction in the turnover rate of the Company's assets.

As of the reporting date, the growth of fixed assets reflected the appearance of innovative oil and gas equipment on the Company's balance sheet, which is leased out to customers and generates rental income. Part of this equipment was sold in early 2020 to a customer from the Oil&Gas sector, who was satisfied with the positive results obtained during the initial operating period.

DuPont model components (DuPont equation) *

|

|

2019 |

2018 |

Change |

|

ROE |

37.8 % |

47.4 % |

–9.6 % |

|

Net profit margin (Profit for the period/Revenue) |

9.1 % |

8.9 % |

+0.2 p.p. |

|

Asset turnover (Revenue/Assets) |

2.09 |

2.69 |

–0.6 |

|

Debt load (Assets/Equity) |

1.98 |

2.28 |

0.0 |

Note: *Balance sheet

values averaged over the respective reporting periods are used.

Dividends

As of the results of 2018, the total amount of dividends (RUB 58.6 million) amounted to 20.0 % of the Company's profit for 2018, calculated in compliance with the financial statements according to IFRS (RUB 293.1 million). The share of dividends paid out corresponds to the level of 20 % of the net profit as prescribed by the Company's Dividend Policy (approved by the Board of Directors in April 2019).

Free Cash Flow

|

RUB mln |

2019 |

2018 |

|

Free Cash Flow to Firm (FCFF) |

–232.6 |

46.1 |

|

Free Cash Flow to Equity (FCFE) |

–236.9 |

49.1 |

The amount of free cash flow at the end of 2019 was negative.

The amount of cash flows from operations (before changes in the working capital, payment of profit tax and change in other assets and liabilities) increased to RUB 483.8 million in the reporting period (growth by 71.0 % compared to the indicator for 2018).

The key reason for the negative free cash flow in the reporting period was an increase in accounts receivable to RUB 1,148.5 million (+75.8 % Y-o-Y). This debt is not troubled (overdue).

Net debt and debt load indicators

|

RUB mln |

12.31.2018 |

12.31.2019 |

Change |

|

Total borrowings |

93.7 |

231.8 |

+57.1 % |

|

Cash and cash equivalents |

246.8 |

27.3 |

–88.9 % |

|

Net Debt |

–153.1 |

204.5 |

- |

|

Net debt/12M EBITDA |

–0.40 |

0.47 |

- |

|

12M EBITDA/12M Interest payments |

19.2 |

17.4 |

–1.8 |

The Net debt/12M EBITDA ratio is at a comfortable level for the Company of 0.47.

As at the end of 2019, interest coverage by 12M EBITDA amounted to 17.4 (19.2 in the previous year).

Economic Value Added (EVA)

EVA calculated based on the adjusted profit:

|

Indicator |

2017

|

2018

|

2019

|

Change in 2019 against 2018 ( % or difference) |

|

Total assets |

1,154,901 |

1,291,187 |

1,834,187 |

42.1 % |

|

Non-interest bearing current liabilities |

441,933 |

455,822 |

651,571 |

42.9 % |

|

Invested capital |

712,968 |

835,365 |

1,182,616 |

41.6 % |

|

Equity

|

541,528

|

694,631

|

885,621

|

27.5 % |

|

Share of equity in invested capital |

75.95 %

|

83.15 %

|

74.89 %

|

–8.3 % |

|

Borrowed capital |

171,440

|

140,734

|

296,995

|

111.0 % |

|

Share of borrowed capital in invested capital |

24.05 %

|

16.85 %

|

25.11 %

|

8.3 % |

|

Risk-free interest rate [3] |

7.59 %

|

8.74 %

|

6.39 %

|

–2.4 % |

|

Beta coefficient (EELT — MOEX) [4] |

0.20

|

0.15

|

0.22

|

0.07 |

|

Average stock market return |

10.00 %

|

10.00 %

|

10.00 %

|

0.0 % |

|

Risk bonuses |

5.00 %

|

5.00 %

|

5.00 %

|

0.0 % |

|

Equity value |

13.08 %

|

13.94 %

|

12.19 %

|

–1.7 % |

|

Annual Percentage Rate (APR) of a loan [5] |

9.43 %

|

9.20 %

|

7.83 %

|

–1.4 % |

|

Profit tax rate |

20.00 %

|

20.00 %

|

20.00 %

|

0.0 % |

|

Cost of borrowed capital |

7.54 %

|

7.36 %

|

6.26 %

|

–1.1 % |

|

Weighted average cost of capital |

11.75 %

|

12.83 %

|

10.71 %

|

–2.1 % |

|

Cost of capital used |

83,784

|

107,156

|

126,603

|

18.1 % |

|

Profit adjusted for tax payments (net profit + interest paid) |

157,498

|

313,029

|

323,669

|

3.4 % |

|

Economic Value Added (EVA) |

73,714

|

205,873

|

197,066

|

–4.3 % |

|

EVA margin |

2.8 %

|

6.3 %

|

6.0 %

|

–0.2 % |

Sources:

[3] https://www.conomy.ru/stavki-gko

[4] https://www.moex.com/ru/forts/coefficients-values.aspx

[5] https://cbr.ru/eng/statistics/bank_sector/int_rat/

About Evropeyskaya Elektrotekhnica Group of Companies

• Evropeyskaya Elektrotekhnica Group of Companies (MOEX: EELT) offers comprehensive solutions in the field of engineering and technological systems for industrial, construction and infrastructural purposes: low and medium voltage distribution equipment, low current systems, lighting systems, industrial electric heating systems and equipment for the Oil&Gas and petrochemical industries.

• As a Russian joint-stock company with high corporate governance standards and financial sustainability, the Company's Mission is to improve people's quality of life with its entrepreneurial vigour and engineering competencies.

• The Company was founded in 2004 and unites a distribution center, engineering departments, an electrical laboratory and specialized production facilities. The company is one of the largest electrical equipment distributors in the Russian Federation and an industrial partner of leading companies on the international engineering market.

• The Company's logistics capabilities include delivery (including non-standard and oversize load) to customers throughout Russia, including hard-to-reach Northern areas, as well as to Central Asia, North Africa and the Middle East.

• The Company has its own production of the following equipment:

-

Complete transformer substations;

-

Medium voltage units;

-

Low voltage panels of up to 6,300A (including metro solutions);

-

Electric lighting systems;

-

Industrial electric heating systems;

-

Cabling and wiring products.

• Areas of application of the Company's competences:

-

Oil&Gas industry;

-

Electric power sector;

-

Peaceful atom,

-

Steel and mining industry;

-

Engineering;

-

Transport infrastructure, water supply and sanitation.

• Evropeyskaya Elektrotekhnica's customers include major Russian companies: Rosneft, Gazprom, NOVATEK, LUKOIL, Sibur and Nizhnekamskneftekhim. Supplies were successfully implemented for the following projects: Power of Siberia, Yamal LNG, Smolensk NPP, Data Center of Sberbank of Russia, the Domodedovo, Sheremetyevo, and Pulkovo Airports, etc.

• New areas of Company activity starting from 2018 include development and production of the following:

-

Modular equipment for the Oil&Gas and petrochemical industries (Company subsidiary ROG-Engineering, Ufa, Republic of Bashkortostan, Russian Federation);

-

Industrial specialized solutions for metro substations (currently being consolidated into the Group's structure: Metrotonnel, Moscow, Russian Federation);

-

Industrial electric heating systems.

• Key financial indicators of PJSC Evropeyskaya Elektrotekhnica (IFRS):

|

|

Revenue (RUB billion) |

Profit for the period (RUB million) |

Assets (RUB billion) |

| 2019 |

3.27 |

298.9 |

1.83 |

|

2018 |

3.29 |

293.1 |

1.29 |

|

2017 |

2.60 |

134.7 |

1.15 |

The personnel headcount is around 350 people. Since September 2017, common shares of PJSC Evropeyskaya Elektrotekhnica are traded on the Moscow Exchange with trading code EELT.

In June 2018, the company was named Import Substitution Leader at the Leader of Competitive Sales annual national awards, in which 450 domestic suppliers from various industries took part.

Contacts:

PJSC Evropeyskaya Elektrotekhnica

Tel.: +7 (800) 600-71-18

Mailing address: 1 Lyotchika Babushkina Street, Building 3, Moscow, 129344

|

Press contacts

|

Contact for investors and analysts

|

For more information, please contact:

Stanislav Martyushev

Director for Corporate Communications and Investor Relations

PJSC Evropeyskaya Elektrotekhnica

Tel. +7 (495) 660-71-18 ext. 164

Find us on social media:

FACEBOOK TWITTER INSTAGRAM VKONTAKTE LINKEDIN YOUTUBE