In H1 2019, PJSC Evropeyskaya Elektrotekhnica boosted its revenue and profit by 4.4% and 11.8% respectively (as per IFRS)

In H1 2019, PJSC Evropeyskaya Elektrotekhnica boosted its revenue and profit by 4.4% and 11.8% respectively (as per IFRS)

September 11, 2019. Moscow — PJSC Evropeyskaya Elektrotekhnica, a leading company in the Russian engineering market, publishes its consolidated financial results as per IFRS for H1 2019.

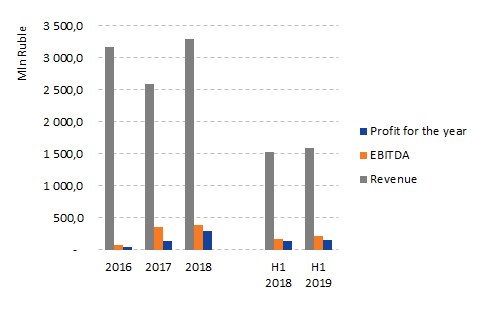

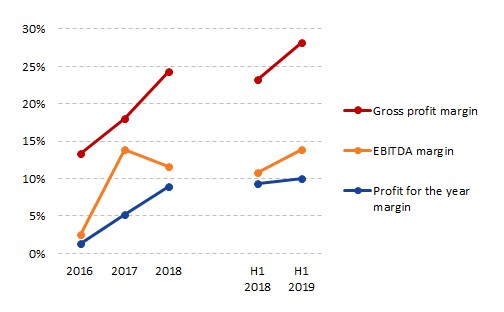

In the reporting period, consolidated revenue rose to RUB 1,599.0 million, which is 4.4% more compared to the first half of 2018, and profit increased by 11.8% for the half-year to a total of RUB 160.3 million. EBITDA reached RUB 221.3 million (+33.0% Y-o-Y), and its profitability grew to 13.8%.

Key financial indicators:

|

In RUB mln, unless otherwise specified |

H1 2019 |

H1 2018 |

Change |

|

Consolidated revenue |

1,599.0 |

1,532.3 |

+4.4% |

|

Gross profit |

450.4 |

355.8 |

+26.6% |

|

Gross profit margin |

28.2% |

23.2% |

+5.0 p.p. |

|

Operating profit |

214.9 |

163.2 |

+31.7% |

|

Operating profit margin |

13.4% |

10.6% |

+2.8 p.p. |

|

EBITDA [1] |

221.3 |

166.3 |

+33.0% |

|

EBITDA margin |

13.8% |

10.9% |

+2.9 p.p. |

|

Profit for the period |

160.3 |

143.4 |

+11.8% |

|

Profit margin for the period |

10.0% |

9.4% |

+0.6 p.p. |

|

|

|

|

|

|

Investment [2] |

198.0 |

310.0 |

-36.1% |

|

Investment in R&D [2] |

37.0 |

105.0 |

-64.8% |

|

Free cash flow to equity (FCFE) [2] |

-147.4 |

-145.9 |

- |

|

Return on equity (ROE) |

43.2% |

51.9% |

-8.7% |

|

|

|

|

|

|

|

Jun 30, 2019 |

Dec 31, 2018 |

Change |

|

Assets |

1,705.5 |

1,291.2 |

+32.1% |

|

Cash and cash equivalents |

86.5 |

246.8 |

-64.9% |

|

Assets/Equity |

2.0 |

2.2 |

-0.2 |

|

Net working capital [2] |

813.0 |

715.4 |

+13.6% |

|

Current ratio |

2.0 |

2.6 |

-0.6 |

|

Net debt [1] |

180.1 |

-153.1 |

- |

|

Net debt/12M EBITDA |

0.41 |

-0.38 |

- |

|

12M EBITDA/12M Interest payments |

16.8 |

25.1 |

-8.4 |

Source: PJSC Evropeyskaya Elektrotekhnica's Consolidated Financial Statement for H1 2019 as reviewed by FBK Grant Thornton audit company.

Notes:

[1] Non-IFRS indicators; the calculation procedure is given below in this press release.

[2] Non-IFRS indicators.

Statement from Management

Sergey Dubenok, Head of PJSC Evropeyskaya Elektrotekhnica Board of Directors, commented on the financial results shown:

"In the first half of 2019, the Company demonstrated positive financial results. Our business profitability continues to increase; the Company's profit margin reached 10.0% for the period. This reflects our earlier decision to focus on high-margin areas, and first of all, on raising the Company's profits.

To rapidly increase production capacities for the introduction of innovative units designed for oil refining and the electric power sector and to complete the testing of various types of such equipment at our customers' facilities, the Company continued to increase its working capital in the reporting period, and also used funds borrowed from related parties.

As of the beginning of September 2019, the Company manufactured eight innovative units of various types, and some of them have already been leased to customers. Our customer's sites in Latin America are being prepared for deployment of our equipment, which will make it possible to considerably save fuel oil (electric power industry).

In addition, we leased to PJSC Lukoil a mobile preliminary water knock-out unit, which was successfully put into operation in August 2019.

The share of

the Technological Systems direction in the Company's revenue structure rose to

18.0% with the profitability exceeding the Engineering Systems direction

indicators. These dynamics correspond to our original plans. At the same time,

revenue generated from the supply of innovative equipment will be reflected

even more in the PJSC Evropeyskaya Elektrotekhnica Consolidated Financial

Statement starting from Q4 2019 to Q1 2020."

Factors of change in the Company's key financial indicators

Consolidated revenue

The Company's consolidated revenue amounted to RUB 1,599.0 million in H1 2019, which is 4.4% higher than in H1 2018.

The deferred income from the new business for leasing innovative units for oil refining and the electric power sector had a deterrent effect on revenue in the reporting six months. The Company publicly announced the launch of a new area of activity in May 2019, even though revenue had not yet been received in the reporting six months, and the corresponding investment and expenses in this period had already been implemented.

Contribution of key areas of activity

in the Company's financial indicators, H1 2019

|

|

Consolidated revenue structure |

Profit structure for the period |

|

Engineering Systems area, engineering centers activities in the electrotechnical market |

82.0% |

75.2% |

|

Technological Systems area supplies equipment for the Oil&Gas and petrochemical industries and the electric power sector |

18.0% |

24.8% |

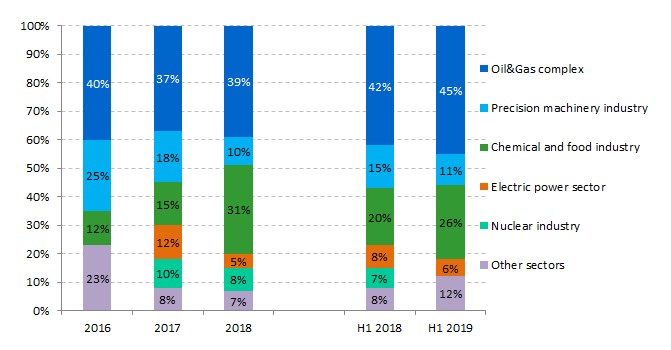

The largest share of the Group's contracts (in terms of delivery costs) in recent years has been for customers from the Oil&Gas complex. A comparable share of deliveries came from companies operating in the chemical and food industry:

Key factors of consolidated revenue growth:

- There is continued growth in scale and "fine-tuning" of the federal network consisting of the Company's 16 engineering centers. The automated control system for project sales was put into operation, which allows for more efficient and accurate coordination between engineering centers of the Company, the Company's partners, project groups and customers.

- The revenue structure contained 7.0% of revenues from deliveries of engineering and technological products for export to customers from the following countries: UAE, Kazakhstan, Uzbekistan, Armenia, Azerbaijan.

- Amid increasing cooperation with Oil&Gas companies and growth in the average size of contracts, the Company's level of income concentration increased in the reporting six months: the number of contracts with top 10 customers in the Company's consolidated revenue structure grew to 64.9% from 50.9% in the corresponding period of previous year.

Dynamics of the Company's key financial indicators

Cost of Sales and Gross Profit

The cost of sales in the reporting six months amounted to RUB 1,148.6 million. Measures to control the cost of sales made it possible to reduce its volume by 2.4%. Alongside revenue growth (+4.4%), this led to a noticeable increase in gross profit to RUB 450.4 million (+26.6% compared to H1 2018). The Company's profitability on gross profit increased by 5.0 p.p. to 28.2%.

Administrative and Selling Expenses

|

RUB mln |

H1 2019 |

H1 2018 |

Change |

|

Wages and social contributions |

121,726 |

37,300 |

226.3% |

|

Transport services |

19,298 |

29,396 |

-34.4% |

|

Electrical installation works |

15,171 |

46,507 |

-67.4% |

|

Operating lease |

10,562 |

17,492 |

-39.6% |

|

Business trips |

7,405 |

11,530 |

-35.8% |

|

Depreciation charges |

5,021 |

3,019 |

66.3% |

|

Consulting and legal services |

4,873 |

14,300 |

-65.9% |

|

Materials and office supplies |

4,003 |

18,864 |

-78.8% |

|

Bank services |

3,401 |

398 |

754.5% |

|

Information services |

3,260 |

7,070 |

-53.9% |

|

Marketing services |

2,451 |

- |

|

|

Communication costs |

2,278 |

2,535 |

-10.1% |

|

Repair and maintenance |

1,163 |

997 |

16.6% |

|

Insurance |

707 |

3,101 |

-77.2% |

|

Storage |

294 |

- |

|

|

Security |

156 |

137 |

13.9% |

|

Other expenses |

15,180 |

5,116 |

196.7% |

|

TOTAL |

216,949 |

197,762 |

9.7% |

The increased expenses on wages and social contributions by 3.3 times in the reporting six months were due to the increase in the number of personnel of Evropeyskaya Elektrotekhnica Group of Companies due to the consolidation of the controlled company, ROG-Engineering LLC, starting from H2 2018 (the number of personnel grew by 200%). In addition, during the reporting quarter, the number of personnel increased (+23%) in the companies included in the consolidation perimeter compared to the data for H1 2018.

ROG-Engineering produces equipment for the Oil&Gas and petrochemical industries. The professional team is formed at the production site in Bashkortostan.

The reduction in transport expenses was due to the fact that delivery expenses can be paid either by the Group company or by the customer, depending on the terms of the contracts. In addition, the geographical location of the customers' facilities varied drastically in different reporting periods. These factors lead to the fact that the total amount of transport expenses may vary significantly from period to period.

The decrease in expenses on materials and stationery was due to a one-time planned increase in costs of this item during H1 2018.

The significant reductions in other types of administrative and selling expenses made it possible to keep their growth rate at a moderate level (+9.7%).

Operating profit

The Company's operating profit increased by 31.7% to RUB 214.9 million. The operating profit margin increased to 13.4% (10.6% in H1 2018).

Operating profit decreased due to growth in both administrative and selling expenses, as well as other income.

EBITDA

EBITDA reached RUB 221.3 million (+33.0% Y-o-Y). The profit margin for this indicator increased to 13.8% in the reporting half of the year (10.9% in H1 2018).

Profit Before Tax

Profit before tax increased by 28.3% to RUB 202.9 million.

Profit for the period

In the reporting half of the year, the Company's profit rose to RUB 160.3 million, which is 11.8% higher than in H1 2018. The profit margin increased to 10.0% from 9.4% in the previous year.

ROE

The Company's return on equity ratio (ROE) decreased to 43.2% (51.9% in the previous year). Factors that have affected the ROE reduction: a reduction in the turnover rate of the Company's assets, and a reduction in the level of financial leverage.

DuPont model components (DuPont equation) *

|

|

|

H1 2019 |

H1 2018 |

Change |

|

|

ROE |

43.2% |

51.9% |

-8.7 p.p. |

||

|

Net profit margin (Profit for the period / Revenue) |

10.0% |

9.4% |

+0.6 p.p. |

||

|

Asset turnover (Revenue / Assets) |

2.13 |

2.58 |

- 0.45 |

||

|

Debt load (Assets / Equity) |

2.02 |

2.15 |

- 0.13 |

||

Note: * Balance sheet amounts averaged over the respective reporting periods are used; ROE and profit and loss report indicators are adjusted to annual scale (doubled).

Dividends

In 2018, the total amount of dividends (RUB 150.1 million) amounted to 51.22% of the Company's profit for 2018, calculated in compliance with the financial statements according to IFRS (RUB 293.1 million). The share of dividends paid out significantly exceeded the minimum level of 20% of the net profit as prescribed by the Company's Dividend Policy (approved by the Board of Directors in April 2019).

Free Cash Flow

|

RUB mln |

H1 2019 |

H1 2018 |

|

Free cash flow to firm (FCFF) |

-147.4 |

-145.9 |

|

Free cash flow to equity (FCFE) |

-319.0 |

-147.4 |

The amount of the Company's free cash flow in H1 2019 was negative.

The amount of cash flows from operations (before changes in the working capital, payment of profit tax and change in other assets and liabilities) increased to RUB 230.3 million in the reporting half year (an increase of 4.2 times compared to the indicator for H1 2019).

At the same time, the volume of the Company's investments in working capital reached RUB 546.8 million (an increase of 2.5 times compared to the indicator for H1 2019), which led to a negative value of free cash flow.

Net debt and debt load indicators

|

RUB mln |

Jun 30, 2019 |

Dec 31, 2018 |

Change |

|

Total borrowings |

266.6 |

93.7 |

+184.6% |

|

Cash and cash equivalents |

86.5 |

246.8 |

-64.9% |

|

Net Debt |

180.1 |

-153.1 |

- |

|

|

|

|

|

|

Net debt / 12M EBITDA |

0.41 |

-0.38 |

- |

|

12M EBITDA / 12M Interest payments |

16.8 |

25.1 |

-8.4 |

Attracting loans from related parties in the amount of RUB 200.0 million on very favorable terms for the Company led to an increase in Net debt / 12M EBITDA to 0.41.

Interest coverage by EBITDA decreased to 16.8 times, while the indicator is still at a very high level.

About Evropeyskaya Elektrotekhnica Group of Companies

• Evropeyskaya Elektrotekhnica Group of Companies (MOEX: EELT) offers comprehensive solutions in the field of engineering and technological systems for industrial, construction and infrastructural purposes: low and medium voltage distribution equipment, low current systems, lighting systems, industrial electric heating systems and equipment for the Oil&Gas and petrochemical industries.

• As a Russian joint-stock company with high corporate governance standards and financial sustainability, the Company's Mission is to improve people's quality of life with its entrepreneurial vigour and engineering competencies.

• The Company was founded in 2004 and unites a distribution center, engineering departments, an electrical laboratory and specialized production facilities. The company is one of the largest electrical equipment distributors in the Russian Federation and an industrial partner of leading companies on the international engineering market.

• The Company's logistics capabilities include delivery (including non-standard and oversize load) to customers throughout Russia, including hard-to-reach Northern areas, as well as to Central Asia, North Africa and the Middle East.

• The Company has its own production of the following equipment:

-

Complete transformer substations;

-

Medium voltage units;

-

Low voltage panels of up to 6,300A (including metro solutions);

-

Electric lighting systems;

-

Industrial electric heating systems;

-

Cabling and wiring products.

• Areas of application of the Company's competences:

-

Oil&Gas industry;

-

Electric power sector;

-

Peaceful atom,

-

Steel and mining industry;

-

Engineering;

-

Transport infrastructure, water supply and sanitation.

• Evropeyskaya Elektrotekhnica's customers include major Russian companies: Rosneft, Gazprom, NOVATEK, LUKOIL, Sibur and Nizhnekamskneftekhim. Supplies were successfully implemented for the following projects: Power of Siberia, Yamal LNG, Smolensk NPP, Data Center of Sberbank of Russia, the Domodedovo, Sheremetyevo, and Pulkovo Airports, etc.

• New areas of Company activity starting from 2018 include development and production of the following:

-

Modular equipment for the Oil&Gas and petrochemical industries (Company subsidiary ROG-Engineering, Ufa, Republic of Bashkortostan, Russian Federation);

-

Industrial specialized solutions for metro substations (currently being consolidated into the Group's structure: Metrotonnel, Moscow, Russian Federation);

-

Industrial electric heating systems.

• Key financial indicators of PJSC Evropeyskaya Elektrotekhnica (IFRS):

|

|

Revenue (RUB billion) |

Profit for the period (RUB million) |

Assets (RUB billion) |

| Н1 2019 | 1.60 | 163.3 | 1.71 |

|

2018 |

3.29 |

293.1 |

1.29 |

|

2017 |

2.60 |

134.7 |

1.15 |

The personnel headcount is around 350 people. Since September 2017, common shares of PJSC Evropeyskaya Elektrotekhnica are traded on the Moscow Exchange with trading code EELT.

In June 2018, the company was named Import Substitution Leader at the Leader of Competitive Sales annual national awards, in which 450 domestic suppliers from various industries took part.

Contacts:

PJSC Evropeyskaya Elektrotekhnica

Tel.: +7 (800) 600-71-18

Mailing address: 1 Lyotchika Babushkina Street, Building 3, Moscow, 129344

|

Press contacts

|

Contact for investors and analysts

|

For more information, please contact:

Stanislav Martyushev

Director for Corporate Communications and Investor Relations

PJSC Evropeyskaya Elektrotekhnica

Tel. +7 (495) 660-71-18 ext. 164

Find us on social media:

FACEBOOK TWITTER INSTAGRAM VKONTAKTE LINKEDIN YOUTUBE Yandex.Zen